What changes does the new Mortgage law introduce in Malaga and the Costa del Sol?

The new mortgage law passed last week in congress, pursues the objective of following the European normative 2014/17/EU, to protect the clients that apply for mortgages, and introduce new changes in relation to the constitution expenses. Its enforcement will start on March 2019, once the senate approves it.

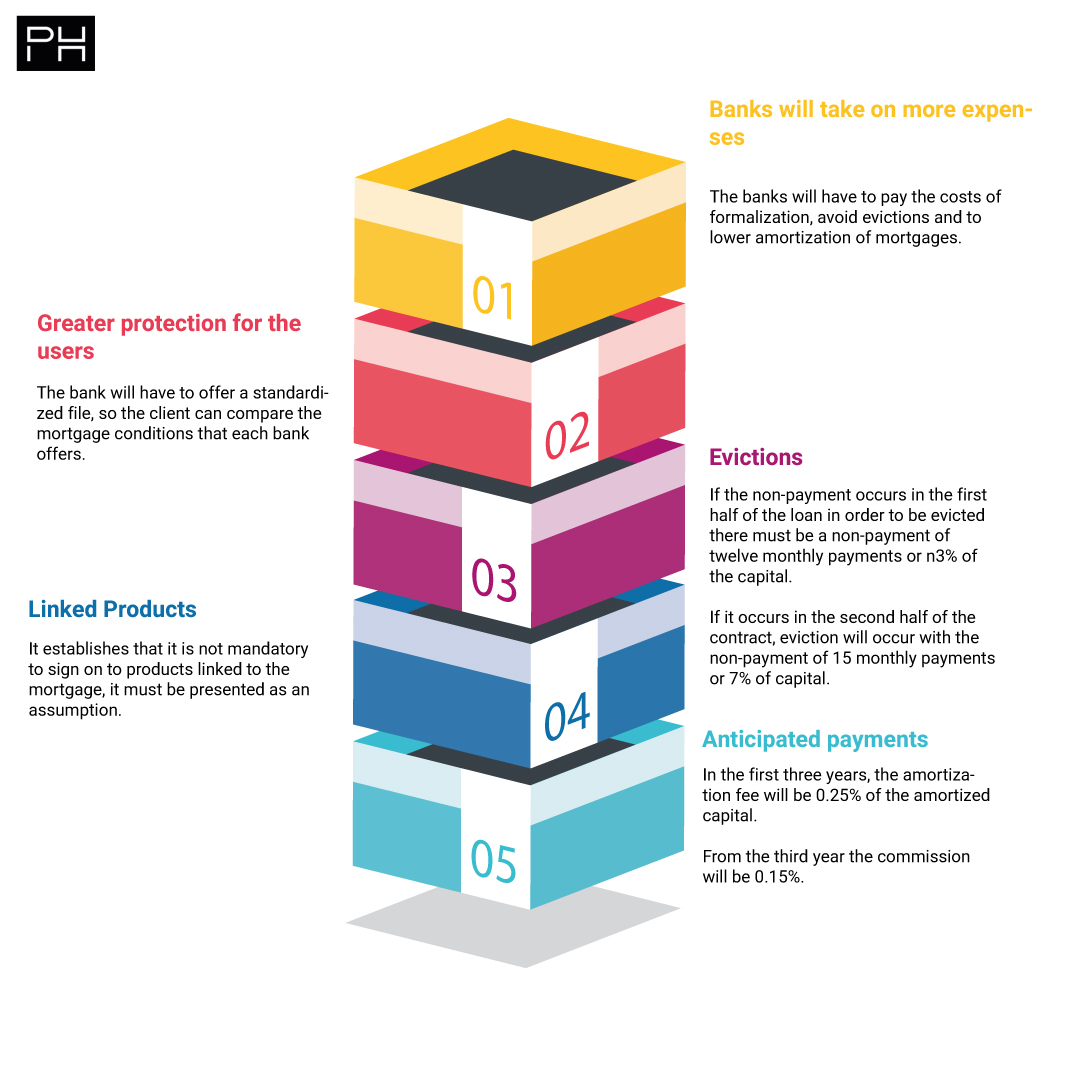

1. The bank is responsible for more expenses

This new law will attempt to protect the consumers in 3 different aspects: to force the banks to pay the formalization expenses, to avoid evictions and to reduce the amortization of the mortgages.

The banks that subscribe a mortgage will pay the tax of Legal Documented Acts (AJD), the first copies of the notary, the expenses of the registry and of the agency, while the client will pay second copies of the notary and the expenses of valuation.

The maximum interest for delays established in mortgage loans will be 3 times the legal interest of the money.

The big question is whether this is going to be a saving for the future clients of mortgaged loans, and the most probable thing is that the banking entities transfer it to the mortgages through an increase of the types of interest.

2. Greater protection for users

The client may visit the notary a day before the signature to receive a free explanation on the commitments he will acquire and those clauses that may harm him. Once all the doubts are solved, the mortgaged future must sign a document where he claims to have understood everything.

The bank must offer a standardized card so that the client can compare the mortgage conditions offered by each entity.

The appraisers will be independent and may be not only appraisal companies but also individuals. In addition, the customer can choose it.

3. Evictions

Up to this moment, banking entities can execute the anticipated expiration of the mortgage loans if the clients do not pay 3 installments. The new Mortgage Law gives greater protection to the client by extending the months of unpaid installments to execute a mortgage contract (step prior to a possible eviction), fixing it in 12 months (or 3% of the granted capital) if the non-payment occurs in the first half of the loan and in 15 months (or 7% of the capital granted) thereafter. Subrogations and novations of mortgage loans will be free from the entry into force of the new law, therefore, will give more freedom to the contractor and will facilitate competition between the different

This law will not enter retroactively in cases where there is already an eviction procedure, and if it will have retroactivity for the rest of the banking entities clients.

The final text does not include dation in payment as a way to protect customers with payment problems.

4. Linked Products

It is established that it is not obligatory to contract products linked to the mortgage, but it is an option.

The European Union wants to end the obligation to accept a series of financial products as a condition for obtaining a mortgage. From now on, financial institutions must present their clients with alternative offers with and without associated products.

As for home insurance (or damage) and life (or payment protection or amortization), banks may require us to hire them. However, the new mortgage law will allow the client to hire them with the insurer they want without making the mortgage loan more expensive, provided that the conditions demanded by the bank are met.

5. Advance payments

The current law establishes a commission for early repayment of 0.5 percent the first 5 years of the mortgage and 0.25 percent from the sixth year of the mortgage. The new law wants to make the costs of early amortization of the mortgage cheaper to equate Spanish law with the European example.

Summary

The banks will pay the mortgage expenses once the law comes into effect (expenses of the deed, the agency and the notarial tariff, in addition to the duty document tax), while the client will have to pay for the expenses derived from the appraisal and the copies of the deeds that you request as well as the payment of expenses related to the sale.

WhatsApp

WhatsApp